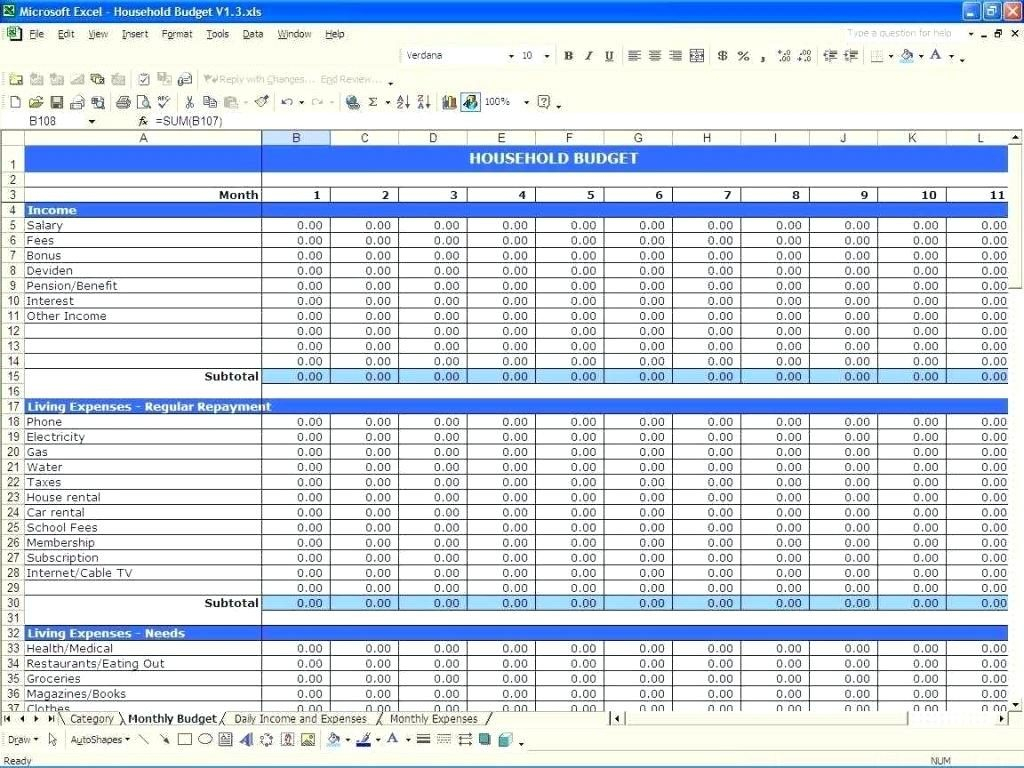

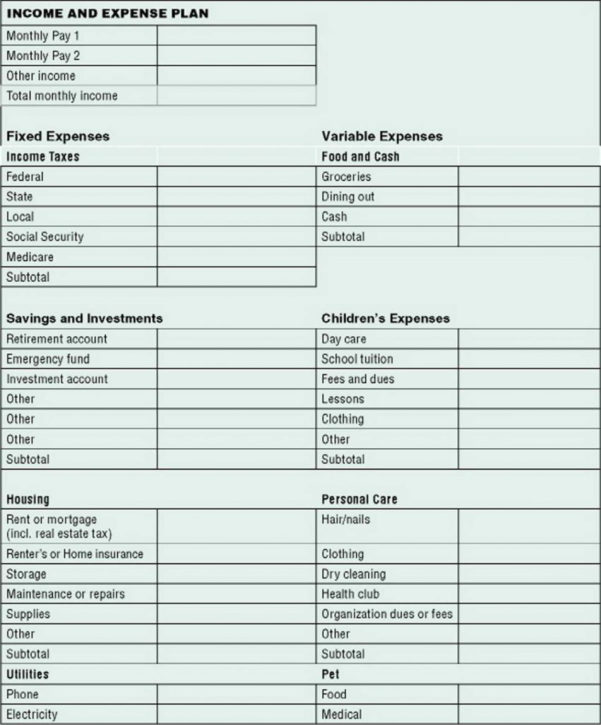

The IRS requires that every business report any income, even if you do not receive a 1099 form for less than $600.Īs an owner or sole proprietor, any non-W2 income must be documented and reported on your tax returns as well. This section would come in handy when you actually do file your taxes as well. You could also download our free self-employment ledger template to track income and expenses.īy keeping a log of your earned income throughout the year, you can stay on top of the financial budgeting for your business and it's financial wellness. Our spreadsheet has a tab to track your company's income which is especially useful to be used as a budget tracker as well. The IRS uses a system to see the average spending for expenses for everyone in a particular field of work, and if your deductions are too far from the averages, it could trigger an IRS audit.īudgeting is important for any company. If the current year, your tracking shows that you wrote off 35%, it could be a red flag.

Let's say in the previous year's Schedule C, you wrote off 15% of your income for meals. the expense types has too much variance or the numbers don't add up, you may need to make adjustments. It is important that you copy and paste your previous year's Schedule C as well to compare it with the current year or new Schedule C. Most of the time, this section of the excel template will be the easiest to use and adjust for your specific company.

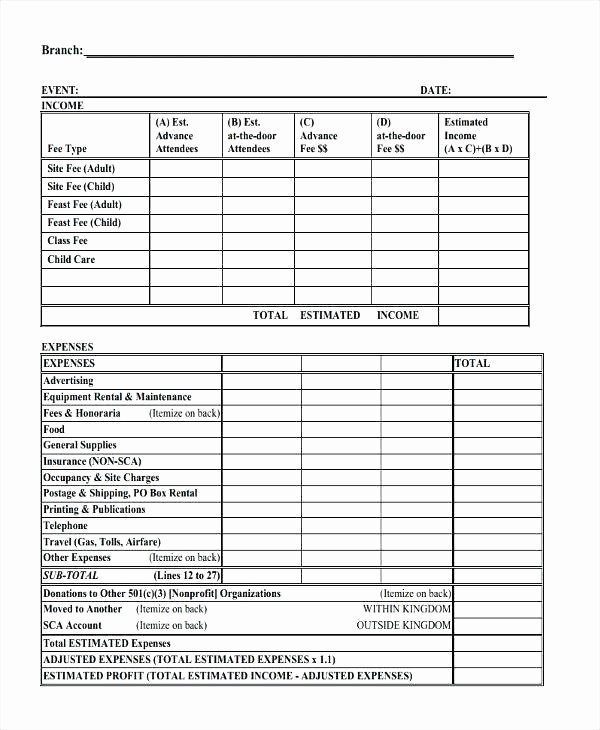

You may find you need to add other categories if you receive more than the typical expense types listed on our sheet. Our spreadsheet has the most common categories for your Schedule C Expense Categories. Enter the date you received the funds, the merchant who paid you, the expense amount, and the Schedule C category. The Schedule C tab on the sheet is pretty straightforward.

0 kommentar(er)

0 kommentar(er)